RPSC RAS 2026 Subject Wise Exam Pattern for Prelims, Mains & Interview Details

- >

- RAS Preparation Resources

- >

- Tax Reforms in India: Various committees

Tax Reforms in India: Various committees

Get in Touch with RASonly!

In 1991, the liberalization reforms brought with them a drastic change in the economic policies of India particularly in the field of taxation. The emphasis has been on re-adjusting the tax regimes, lowering excessive tax rates and stemming out tax evasion. It has been adopted in a trend of moderate tax rates to encourage savings, better voluntary disclosure of income, and better mechanisms of revenue collection.

Key Tax Reforms in India

1. Reduction in Corporate Tax

The rate of corporate taxes has been slowly cut over the years to ensure that Indian industries become more competitive in the international market.

2. Implementation of GST

In 2016, the complex Indian taxation was simplified with the introduction of the Goods and Services Tax (GST) Act. GST will endeavor to:

- Boost revenue generation.

- Reduce tax evasion.

- Integrate one national market.

- It came into effect in July 2017.

3. Streamlining of processes.

- To enhance adherence, there is a streamlining of many processes such as reduction in tax rates and reduction in the processes of filing.

Direct Tax Reform committees.

1. Kelkar Committee (2002)

Recommendations:

- Make tax laws easier and less complex.

- Standardize taxes, reduce tax rates.

- Expand the tax base, add more entities and individuals.

- Storing exemptions to seal tax avoiding loopholes.

2. Parthasarathi Shome Committee (2012).

Recommendations:

- Offer safeguards against the misuse of the General Anti-Avoidance Rules (GAAR).

- Establish explicit standards of identifying tax avoidance.

- Adhere to international standards in order to enjoy foreign investments.

3. Direct Tax Code (DTC) Committee (2009).

Recommendations:

- Make the tax structure simpler with less number of slabs and less deductions.

- The elimination of exemptions to widen the tax base.

- Lower corporate tax rates.

- Improve the use of technology in administration of tax and lessen tax evasion.

The Indirect Tax Reform committees.

1. Raja J. Chelliah Committee (1991)

- Recommendations:

- Implement Value added tax (VAT).

- Equalize Commonwealth and state taxes.

- Free the most needed goods of taxes, and equalize administration.

2. Kalyani Menon Sen Committee (2002)

- Recommendations:

- Make customs and excise processes simpler.

- Facilitate the use of electronic filing and minimize compliance costs.

- Make trade open and easy.

3. Arvindsubramaniancommittee (2015).

- Recommendations for GST:

- Suggest a GST rate of revenue-neutrality (RNR).

- Mechanism of compensating the states that will avoid loss of revenue.

- There are also extra levies on precious metals and interstate.

Global Minimum Corporate Tax (GMCT)

Context

- GMCT focuses on multinational corporations (MNCs) which simply transfer profits to low tax jurisdictions without actually moving operations.

There are two pillars in GMCT Framework:

- Pillar One: Distributes taxable revenue to jurisdictions of the market.

- Pillar Two: Protects that there is a proper rate of tax of income.

Impact

- The implementation of GMCT can make India rethink tax policies such as Equalization Levy on MNCs (e.g. Google, Facebook) after its adoption.

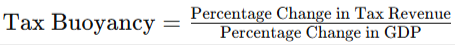

Tax Buoyancy

- Definition Tax buoyancy is the response of tax revenues to the growth of the economy.

- Formula:

- Interpretation:

- Buoyancy > 1: The increase in tax revenues exceeds that of the economy (positive tax administration).

- Buoyancy < 1: The growth of revenues is slower than the growth of the economy (tax evasion or weakening base).

- Buoyancy = 1: The tax revenues increase at the equal rate as the economy.

Conclusion

Economic growth and compliance have been encouraged in India through tax reforms which are motivated by different committees. The GST, reduction in corporate tax and other procedural simplifications are reforms that seek to raise tax revenues, reduce tax evasion and develop a more effective and transparent system. Nevertheless, evaluation should be carried out continuously to ascertain that these reforms remain within their purpose especially with the advent of universal tax frameworks such as GMCT.

Post Category

- RAS Salary

- Result

- RAS Admit Card

- RAS Job

- RAS Cutoff

- Preparation Tips

- RAS Answer Key

- RAS Exam Analysis

- RAS Syllabus

- RAS Previous Year Papers

- RPSC RAS Exam Pattern

- RAS Interview

- RAS Mains Exam Date

- RAS Vacancy

- RAS Test Series

- RAS Best Books

- RAS Preparation Resources

- RAS Coaching Centre

- History

- Polity

- Geography

- Economics

- Science

- Art and Culture

- RPSC RAS Application Form

- RPSC RAS Notification

RASonly Interview Guidance Program

Mr. Ashok Jain

Ex-Chief Secretary Govt of Rajasthan

- IAS officer of the 1981 batch, Rajasthan cadre.

- Passionate about mentoring the next generation of RAS officers with real-world insights.

- Got retired in Dec 2017 from the post of Chief Secretary of the state of Rajasthan.

Mr. Guru Charan Rai

Ex-ASP / SP in Jaisalmer

- Guru Charan Rai, IPS (Retd), retired as Inspector General of Police (Security), Rajasthan, Jaipur in 2017.

- Served as ASP and SP in Jaisalmer, Nagaur, Sri Ganganagar, Sawai Madhopur, Dausa, Sikar, and Karauli.

- He also held key positions as DIGP and IGP in the Law and Order division.

Mr. Rakesh Verma

Ex-IAS Officer, B.Tech, MBA, and M.A. (Economics)

- IAS officer of the 1981 batch and retired in Chief Secretary Rank.

- Civil servant of high repute and vast experience.

- Has been teaching UPSC CSE subjects for the last six years.

Related Post

Daily Current Affairs for RAS Exam Preparation 2026

Rajasthan Pavilion Shines at Stone Mart Jaipur 2026

February 07, 2026

Rajasthan Achieves 3,000 MW Under PM-KUSUM Scheme

February 07, 2026

Gram Utthan Shivirs Strengthen Rural Governance in Rajasthan

February 07, 2026

Jaipur Badminton: 72-Minute U-15 Final Creates Record

February 06, 2026👉🏻 Register Today to Join Classes! 👍🏻

- Team RASOnly -

🎯 Benefits of RASOnly Coaching:

- ✅ 1:1 Mentorship with RAS Officers

- ✅ Experienced and Expert Faculty

- ✅ Free Library Access

- ✅ Daily Minimum 4 Hours Must

- ✅ Comprehensive Study Material

- ✅ Regular Tests & Performance Analysis

- ✅ Personalized Guidance & Doubt Solving

- ✅ Online & Offline Class Options

- ✅ Affordable Fees with Quality Education

Key Highlights:

- 👉🏻 3-Day Refund Policy

- 👉🏻 New Batch Starting from 04 August

- 👉🏻 Registration Amount: Only ₹1000