RAS Prelims 2023 History & Culture Analysis: India, Rajasthan, and Art & Culture Breakdown

Inflation: Concept, Impact, and Control Mechanisms

Get in Touch with RASonly!

Inflation is the rise in general price levels that affects purchasing power, business costs, and economic stability. This article explains its causes, types, impacts, and the tools governments and central banks use to control it, offering a clear overview for understanding price changes in the economy.

Inflation sits at the center of almost every conversation about the economy. It affects how far your money goes, how businesses plan for the future, how governments set policy, and how investors position their portfolios. When inflation rises, people notice it first at the grocery store, the fuel pump, or in rent. When it falls, the economy reacts in a different set of ways that can be equally important.

This article breaks down the idea of inflation in a simple, structured way. We will look at what it is, why it happens, how it impacts people and businesses, and what steps governments and central banks use to keep it under control. A detailed table near the end summarizes the main concepts so readers can compare them quickly.

What Is Inflation?

Inflation refers to the sustained increase in the average price level of goods and services in an economy over time. It does not focus on the price of one product rising. Instead, it looks at a broad set of items to see whether the general cost of living is trending upward.

How Inflation Is Measured

This is usually measured by the Consumer Price Index. It monitors the developments of prices of a representative household basket of goods including food, housing, clothing, transport, utilities, and medical care. Other indicators are Wholesale price index and the Producer price index that keep track of the prices at the lower stages of production.

The inflation is normally calculated as a percentage. When the rate is 5 percent, then it implies that the average price level has increased by 5 percent relative to the period before it.

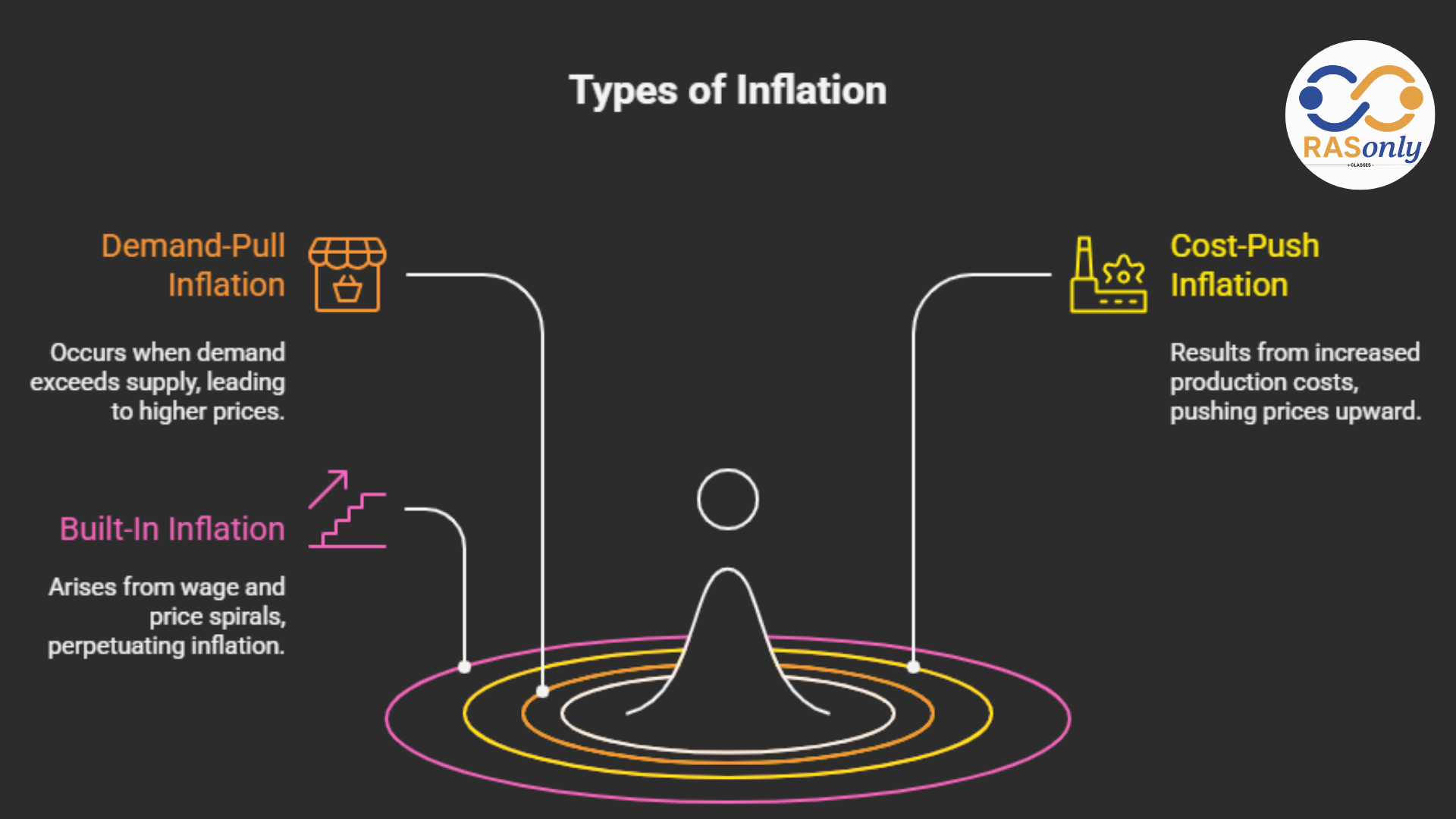

Types of Inflation

This is explained by the various types of inflation that can be discussed to understand the reasons behind the increase in prices and the reaction of policy makers.

1. Demand-Pull Inflation

This occurs when the economy has low supply and high demand. Prices increase when there is a surplus of demand in number of people compared to production capacity of the economy. It is usually found when the economy is doing well, unemployment levels are low and consumer confidence is on the increase.

2. Cost-Push Inflation

This happens when the cost of production increases and companies transfer them to the consumers. Costs can also be drawn up by wages, raw materials, fuel and disruptions in the supply chain. This kind may occur in cases where the demand is not very high.

3. Expectations-Driven (Built-In) Inflation.

The expectation can maintain inflation. When individuals anticipate an increase in prices, wage demands by employees rise and companies raise prices to meet the wage bills. This forms a cycle which is repeated unless interrupted.

4. Imported Inflation

A nation can bring the inflation when the nation is largely dependent on the foreign goods or commodities. In case of an oil spike of prices in the world market or a weak national currency, the price of imported goods goes up and this will raise the general prices.

Why Inflation Happens

There is hardly ever a single cause of inflation. Typically, it is caused by a combination of factors, which impact supply, demand, cost of production, and financial situation.

Excess Money Supply

When the quantity of money in circulation is high as compared to the quantity of goods and services in the market the worth of the currency is lowered. The increased supply of money pursuing the same quantity of goods results in an increase in prices. This correlation is usually linked to the central bank policies.

Supply Chain Constraints

The supply of goods may be disrupted by natural calamities, geopolitical conflicts, pandemics, or trade wars. The reduction in supply and a fixed demand increase the prices.

Rising Input Costs

Energy, workforce and raw materials may end up being costly. Transportation and production costs become higher in most industries in case oil prices are high.

Strong Consumer Spending

Households spend more when they are optimistic and financially assured. The high demand may lead to a powerful increase in the prices in case the businesses are not able to meet.

The Impact of Inflation

Inflation has diverse effects on the economy including a decrease in purchasing power and an increase in interest rates, as well as the increase of income inequality and the returns on investments. It also affects the export competitiveness and increases the costs of doing business which makes it difficult to plan the economy.

Reduced Purchasing Power: Inflation undermines the purchasing power of money, that is, consumers are unable to purchase as many goods and services using the same income and eventually these will result in the quality of life and standard of living.

High Interests: To avoid the inflation central banks are commonly increasing interest rates and consequently, borrowing has become costly to people and businesses, and this may put a hold on economic growth and investment activities.

Income Inequality: Inflation affects the income groups differently. The pinch is more on the lower-income households because a greater percentage of their earnings is on necessities, which further increases the divide in socioeconomic stratification.

Investment Returns: Inflation lowers real returns on investments particularly fixed-income assets since the real purchasing power of returns is lowered which may deter savings and long-term investment.

Export Competitiveness: Soaring domestic prices cause export to be less competitive in the international market, with the foreign consumers having alternative cheaper products in other countries, thus damaging the industries that depend on export revenues.

Business Costs and Planning: Inflation increases operation expenses of business particularly in the costs of materials and labor creating difficulty in pricing and long-term planning as business strives to maintain its profit margin.

Table: Overview of Inflation Concepts

Below is a summary table that helps compare the major ideas discussed so far.

| Concept | Description | Key Drivers | Typical Outcome |

|---|---|---|---|

| Demand-Pull Inflation | Prices rise due to strong demand | High consumer spending, economic growth | Higher prices, potential overheating |

| Cost-Push Inflation | Prices rise due to higher production costs | Wage growth, energy prices, raw materials | Higher prices, reduced output |

| Built-In Inflation | Inflation sustained by expectations | Wage-price cycles | Persistent inflation |

| Imported Inflation | Inflation caused by higher global prices or weaker currency | Exchange rate drops, global commodity spikes | Rising cost of imports |

| Consumer Impact | Reduced purchasing power | Price increases outpacing wages | Lower household spending power |

| Business Impact | Higher costs and uncertainty | Input cost increases | Reduced profits, cautious planning |

| Government Actions | Policies to control inflation | Monetary and fiscal tools | Stabilized prices or slower economic growth |

Control Mechanisms: How Inflation Is Managed

The inflation is not self-corrected. Governments and central banks are able to use various instruments to manipulate the rate of price adjustment.

Monetary Policy Tools

The Monetary Policy Committee is entrusted with fixing the benchmark policy rate required to contain inflation within the specified target level.

Interest Rate Adjustments: Increasing interest rates reduces the rate of borrowing and expenditure. The cost of loans increases and this dampens demand. Reduction of interest rates is the opposite. Interest rates are often increased when the central banks feel that the inflation rate is increasing at an unsustainable rate.

Open Market Operations: The central banks purchase or sell government securities to control money supply. The sale of bonds eliminates money in circulation. Purchases of bonds introduce money in the system. Such acts influence liquidity and the short-term interest rates.

Reserve Requirements: Banks are required to maintain reservation amounts of deposits. When reserve requirements are raised by the central bank, banks are left with less money to lend out and this slows down economic activity and causes the price pressure to cool.

Fiscal Policy Tools

Taxation and government spending are some of the ways through which governments can control inflation.

Reducing Public Spending: When a government reduces its expenditure the total demand in the economy reduces. This can assist in alleviating inflation especially when the consumption rate by the private sector remains a steady rate.

Increasing Taxes: Increased taxes lower the disposable income that decreases consumer spending. This option is normally taken cautiously by the governments since it can also reduce the growth of the economy.

Price Controls and Subsidies: In exceptional events, governments regulate the prices by applying price ceilings or price subsidies in favor of the consumers. Such actions can provide relief but can give rise to distortions or deficiencies when taken over a long period.

Supply-Side Measures

There is a slight amount of inflation caused by the production bottlenecks or shortages of supply. The inflation can be controlled by means of policies that enhance supply and without damaging the growth.

Improving Infrastructure: Transport, logistical and digital systems are better and assist in the easy movement of goods and minimization of shortages and costs in supply.

Encouraging Production: Governments can provide incentives to industries through lowering tariffs on imports, providing incentives or deregulation. Increased production will lead to increased supply and this will stabilize prices.

Investing in Workforce Development: Productivity is enhanced by a skilled workforce. Increased productivity translates to increased output with no increased costs proportionately, which curbs inflation.

Inflation Targeting: A Modern Approach

Many central banks set a clear inflation target, such as 2 percent. This target guides their decisions and helps anchor public expectations. When people and businesses believe inflation will stay in a certain range, they behave in ways that help maintain stability. This makes inflation targeting an important tool in modern economic management.

The Role of Global Factors

Inflation today is influenced by global trade, energy markets, currency movements, technology, and international conflicts. Countries no longer operate in isolation. A spike in global oil prices, for example, affects transportation and manufacturing worldwide. A shift in exchange rates can make exports cheaper or more expensive. Understanding global connections is essential to forecasting inflation.

Why Stable Inflation Matters

Low and predictable inflation supports long-term economic growth. When price levels are stable, businesses can plan, investors can set strategies, and households can manage their budgets with confidence. High or unpredictable inflation creates uncertainty, disrupts planning, and can destabilize financial systems.

Price stability does not mean zero inflation. A small, steady increase encourages spending rather than hoarding cash, which supports healthy economic activity.

Important Figures in Inflation Theory, Policy, and Measurement

| Category | Name | Contribution / Description |

|---|---|---|

| Key Economists Linked to Inflation Theory | Milton Friedman | Known for the idea that inflation is mainly a monetary phenomenon. His work influenced modern monetary policy. |

| John Maynard Keynes | Supported government intervention to manage inflation and unemployment during economic cycles. | |

| Irving Fisher | Developed the Fisher Equation linking inflation, interest rates, and real returns. | |

| Adam Smith | Not focused only on inflation but shaped modern understanding of prices and markets. | |

| Paul Samuelson | Helped build modern macroeconomic frameworks related to price levels. | |

| Robert Lucas Jr. | Introduced rational expectations theory, which explains how people anticipate inflation. | |

| Key Central Bankers Known for Controlling Inflation | Paul Volcker | Former Federal Reserve Chair who curbed high inflation in the late 1970s and early 1980s through sharp rate hikes. |

| Alan Greenspan | Led the Federal Reserve for nearly 20 years and maintained long-term low inflation. | |

| Ben Bernanke | Managed inflation and financial instability during the 2008 global crisis. | |

| Christine Lagarde | President of the European Central Bank, responsible for steering Eurozone inflation policy. | |

| Jerome Powell | Current Federal Reserve Chair managing recent global inflation spikes. | |

| Influential Policy Leaders and Thinkers | Friedrich Hayek | Opposed excessive government control and influenced modern debates on inflation. |

| Janet Yellen | Former Fed Chair and current U.S. Treasury Secretary, known for balancing inflation and employment goals. | |

| Raghuram Rajan | Former Governor of the Reserve Bank of India, strong advocate of inflation-targeting frameworks. | |

| Amartya Sen | Nobel laureate whose work highlights the social impact of inflation and economic inequalities. | |

| Contributors to Price Index and Measurement | Simon Kuznets | Created national income accounting systems that inform modern inflation measurement. |

| Wesley Mitchell | Studied business cycles and price trends; co-founded the National Bureau of Economic Research. | |

| Arthur Pigou | Linked price levels with consumer behavior through Pigovian theories. |

Conclusion

Inflation is a complicated yet a necessary element of economic life. It has a role in daily choices of persons and enterprises. It influences the government policies and monetary markets. Knowing the background of inflation, the causes of inflation and the manner in which it is managed enables human beings to make prudent decisions concerning spending, saving and investing.

This article offers a full perspective of the direction taken by the levels of prices and the reaction to it by the societies by decomposing the concept of inflation and analyzing its impacts and control systems. Having a clear idea of inflation, the readers will be more prepared to navigate the economic challenges and opportunities of the fluctuating prices.

Post Category

- RAS Salary

- Result

- RAS Admit Card

- RAS Job

- RAS Cutoff

- Preparation Tips

- RAS Answer Key

- RAS Exam Analysis

- RAS Syllabus

- RAS Previous Year Papers

- RPSC RAS Exam Pattern

- RAS Interview

- RAS Mains Exam Date

- RAS Vacancy

- RAS Test Series

- RAS Best Books

- RAS Preparation Resources

- RAS Coaching Centre

- History

- Polity

- Geography

- Economics

- Science

- Art and Culture

- RPSC RAS Application Form

- RPSC RAS Notification

RASonly Interview Guidance Program

Mr. Ashok Jain

Ex-Chief Secretary Govt of Rajasthan

- IAS officer of the 1981 batch, Rajasthan cadre.

- Passionate about mentoring the next generation of RAS officers with real-world insights.

- Got retired in Dec 2017 from the post of Chief Secretary of the state of Rajasthan.

Mr. Guru Charan Rai

Ex-ASP / SP in Jaisalmer

- Guru Charan Rai, IPS (Retd), retired as Inspector General of Police (Security), Rajasthan, Jaipur in 2017.

- Served as ASP and SP in Jaisalmer, Nagaur, Sri Ganganagar, Sawai Madhopur, Dausa, Sikar, and Karauli.

- He also held key positions as DIGP and IGP in the Law and Order division.

Mr. Rakesh Verma

Ex-IAS Officer, B.Tech, MBA, and M.A. (Economics)

- IAS officer of the 1981 batch and retired in Chief Secretary Rank.

- Civil servant of high repute and vast experience.

- Has been teaching UPSC CSE subjects for the last six years.

Related Post

Daily Current Affairs for RAS Exam Preparation 2026

First Maharudra Shaktipith to Be Established in Jaipur

January 27, 2026

Padma Awards 2026: List, Numbers and Rajasthan Winners

January 27, 2026

Vande Mataram 150 Second Phase Launched in Rajasthan

January 27, 2026

Rajasthan IT Games 2025-26 Launched in Jaipur

January 27, 2026👉🏻 Register Today to Join Classes! 👍🏻

- Team RASOnly -

🎯 Benefits of RASOnly Coaching:

- ✅ 1:1 Mentorship with RAS Officers

- ✅ Experienced and Expert Faculty

- ✅ Free Library Access

- ✅ Daily Minimum 4 Hours Must

- ✅ Comprehensive Study Material

- ✅ Regular Tests & Performance Analysis

- ✅ Personalized Guidance & Doubt Solving

- ✅ Online & Offline Class Options

- ✅ Affordable Fees with Quality Education

Key Highlights:

- 👉🏻 3-Day Refund Policy

- 👉🏻 New Batch Starting from 04 August

- 👉🏻 Registration Amount: Only ₹1000