RAS Prelims 2023 History & Culture Analysis: India, Rajasthan, and Art & Culture Breakdown

Goods and Services Tax (GST): A Complete and Clear Guide

Get in Touch with RASonly!

Goods and Services Tax (GST) is India’s comprehensive indirect tax system introduced to replace multiple central and state taxes with a single unified structure. It is a destination-based, multi-stage tax levied on the supply of goods and services, allowing seamless input tax credit to avoid tax cascading. GST aims to simplify compliance, improve transparency, and create a single national market. It has significantly contributed to tax formalisation and more efficient revenue collection in India.

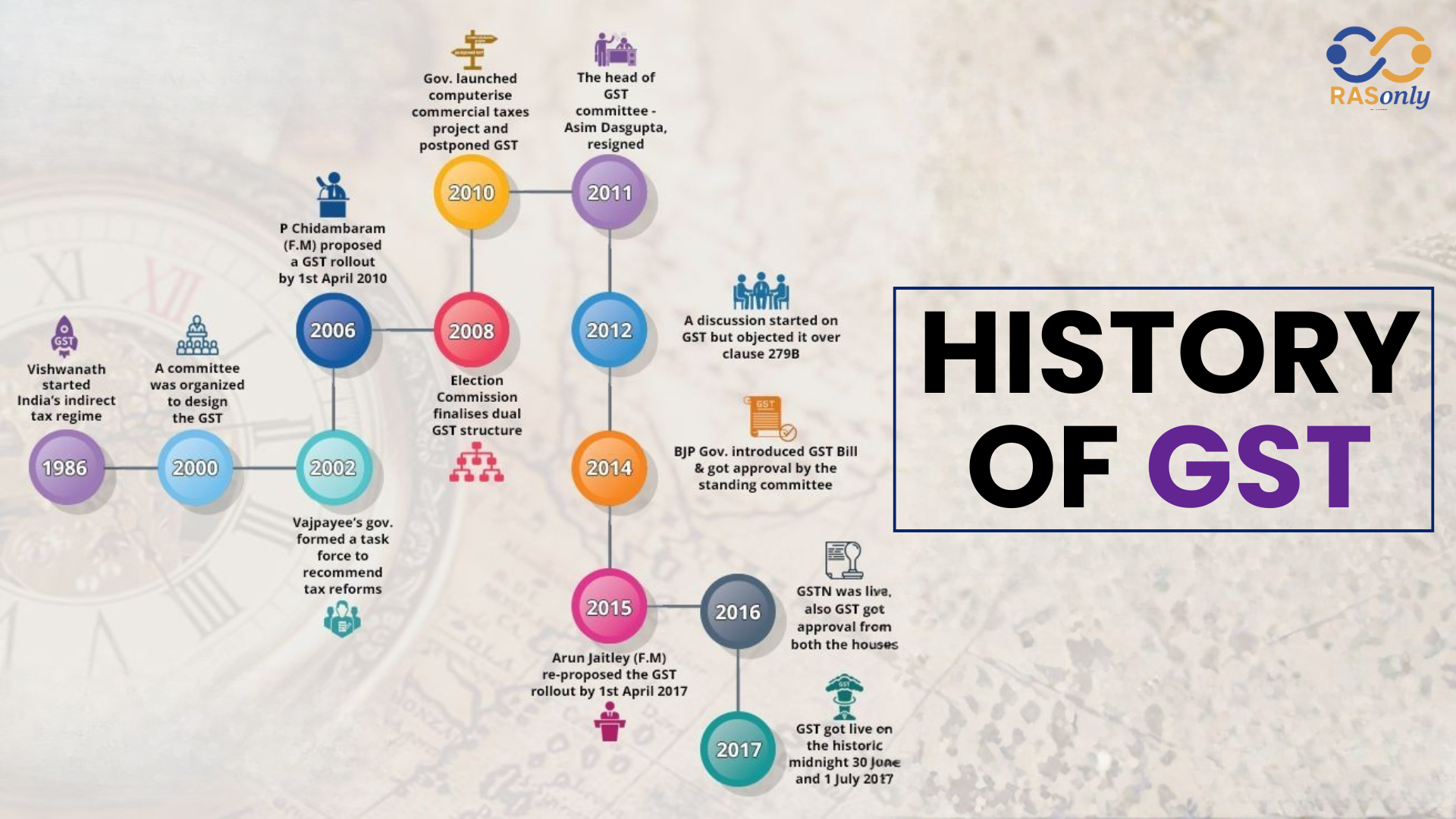

The Goods and Services Tax or GST is one of the most radical tax reforms that has been witnessed in the Indian economy. GST was introduced in order to streamline the indirect tax structure, which previously had a complicated network of various central and state taxes, into one tax structure. Its main objective was to remove the trickle-down effect of taxation, enhance transparency, and enhance compliance, as well as establish a unified national market.

The problem before GST was that businesses in India had to deal with various tax laws in various states, several points of taxation, and no smooth credit in terms of paying taxes. This was fundamentally altered by GST in which a destination-based consumption tax is imposed, where tax is imposed at each value addition phase though taxes paid in the past can be credited. Despite this being a difficult process, GST has transformed the way businesses are conducted and governments are able to raise revenue.

What is GST?

GST is known as the Goods and Services Tax. It is an indirect tax which has replaced many indirect taxes in India such as the excise duty, VAT, services tax, etc. The Goods and Service Tax Act was passed in the Parliament on 29th March 2017 and came into effect on 1st July 2017.

In other words, Goods and Service Tax (GST) is levied on the supply of goods and services. Goods and Services Tax Law in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. After subsuming majority indirect taxes, GST is a single domestic indirect tax law for the entire country.

Before the Goods and Services Tax could be introduced, the structure of indirect tax levy on goods in India was as follows:

Types of GST in India

India’s GST law recognizes four broad categories of GST:

1. CGST - Central Goods and Services Tax, collected by the central government on intra-state supplies.

2. SGST - State Goods and Services Tax, collected by the state government on intra-state supplies.

3. IGST - Integrated Goods and Services Tax, collected by the central government for inter-state supplies; the revenue is apportioned between the center and the states.

4. UTGST - Union Territory Goods and Services Tax, similar to SGST but applicable in union territories without legislatures.

These categories ensure both levels of government can participate in tax collection while preserving destination-based consumption taxation.

GST in India: Key Background Explained in Table Form

| Aspect | Detailed Explanation |

|---|---|

| When GST was introduced | The Goods and Services Tax (GST) was introduced in India by a set of laws passed in 2017, and it became operational on 1 July 2017. The buildup included model laws, constitutional amendments, state and central legislation, and the creation of the GST Council to manage joint decision-making. The Council met many times beforehand to agree on rates, procedures and the rollout plan so that states and the Center could transition from multiple pre-existing levies to a single, integrated system. |

| Why GST was introduced | GST was introduced to overcome the inefficiencies of the earlier indirect tax regime. Before GST, multiple taxes such as excise duty, service tax, VAT, octroi, and entry tax were levied at different points, often without credit for taxes already paid. This led to tax cascading, higher costs, complex compliance, and fragmented markets. GST aimed to simplify taxation, reduce the cost of doing business, increase tax compliance, and integrate India into a single national market. |

| Impact of GST | The impact of GST has been wide-ranging. It simplified the tax structure and improved transparency in pricing. Businesses gained from input tax credit and reduced logistics barriers. Government tax collections became more data-driven and systematic. However, initial challenges included compliance burdens, frequent rule changes, and technological issues. Over time, GST has contributed to higher tax formalisation and better revenue tracking, though reforms are still ongoing. |

Read More: Tax System In India

GST Rate Structure

The rationalized GST rate structure seeks to rationalize the Indian indirect taxation system by moving the major percentage of goods and services of the previous 12% and 28% tax compliance to a more simplified and rationalized tax rate. This reorganization will enable the decrease of the complexity, enhancement of compliance, and increase of the transparency of taxation to businesses and consumers.

| GST Rate | Applicable Goods and Services (Examples) |

|---|---|

| 0% (Exempt) | Essential items such as fresh fruits and vegetables, milk, curd, bread, and other basic food products are exempt from GST. Education and healthcare services, life and health insurance, and most life-saving medicines also fall under the zero-tax category to ensure affordability for the public. |

| 5% | It is covered by this slab, which houses household and daily-consumption products like packaged food (biscuits and namkeen), hair oil, soap, toothpaste and the majority of medicines. It also includes small-value apparel and footwear, along with essential services like non-AC hotels and local salons. |

| 18% | Most consumer durables that include air conditioners, televisions, refrigerators, and washing machines are subject to the 18 percent rate. It also deals with small cars, motorcycles up to 350 cc, and automobile parts and is spreading a wide array of services such as telecom, IT, and financial services. |

| 40% | The rates of taxing luxury and demerit goods are higher. These are luxurious cars, motorcycles that are over 350cc, soft drinks and activities that attract heavy taxation like online games and casinos, that are meant to discourage excessive use. |

| Special Rates | Some goods are subjected to special rates. Gold, silver, and counterfeit jewelry will be taxed at a rate of 3% and rough precious and semi-precious stones will be taxed at a reduced rate of 0.25 to sustain the gems and jewelry sector. |

Input Tax Credit: The Core of GST

The Input Tax credit (ITC) is one of the most significant aspects of GST. Under ITC, the tax paid by the businesses on inputs would be deductible from the tax paid on the outputs in the businesses.

As an example, when a manufacturer pays GST on raw materials and subsequently sells the finished good, the payments made on the raw materials tax can be countered with the payments made on the sales tax. This eliminates the multiplier effect of taxes and makes GST apply only to value addition.

Importance of GST

GST is important for several reasons:

- First, it simplified India’s indirect tax system by merging multiple taxes into one framework. This reduced confusion and increased transparency.

- Second, GST helped create a unified national market by removing state-level trade barriers. Earlier, goods had to pass through check posts, increasing transport time and cost. GST reduced these inefficiencies.

- Third, GST improved tax compliance by bringing businesses into a digital tax system. Online registration, return filing, and invoice matching created a strong audit trail.

- Fourth, GST promoted formalisation of the economy. Businesses that earlier operated outside the tax system were encouraged to register to claim input tax credit.

Impact of GST on Businesses

For businesses, GST brought both benefits and challenges. On the positive side, it reduced the overall tax burden by allowing seamless credit. Logistics costs declined as inter-state movement became smoother. Large companies benefited from simplified supply chains and centralised warehouses.

However, small and medium enterprises faced difficulties, especially during the initial years. Compliance requirements, return filing, and adapting to digital systems were challenging. Over time, the government introduced simplified schemes such as the composition scheme and reduced compliance for smaller taxpayers.

Impact of GST on Consumers

For consumers, GST made taxation more transparent. The tax component is clearly shown on invoices, helping consumers understand how much tax they pay. In some cases, prices of goods declined due to the removal of cascading taxes, though this varied across sectors.

The overall impact on inflation has been moderate, as rate rationalisation and efficiency gains balanced price changes.

GST and Federalism in India

GST had a remarkable impact on CentreState relations in finances. Decisions made on tax are made jointly in the GST Council, which consists of both states and the Centre. This collaborative strategy also provides shared decision-making but has also brought about issues of revenue sharing and compensation.

The GST Council is among the most significant major federal institutions in India because it dictates the tax rates, exemptions, and rules of the procedure.

Challenges and Criticisms of GST

GST has been criticized in spite of its merits. The multi-rate structure is complex. The changes in rules were frequent and caused uncertainty in business. Smaller firms continue to encounter demands of compliance. Litigation has been on the rise due to fights over classification and eligibility for input tax credit.

The issues of revenue concerns of states, as well as delays in compensation, also became one of the key matters of concern, especially in the economic downturn periods.

Recent Developments and the Way Forward

GST has been tried to be simplified in the recent years. These are rate rationalization, better technology on the GST portal, tighter measures on tax evasion and deliberation on the reduction of the number of tax slabs.

The success of GST in the long term relies on the consistency of the policies, the ease of compliance, the enhancement of the resolution of the disputes and the ongoing collaboration of states with the Centre.

Conclusion

The Goods and Services Tax is one of the milestones that revolutionized the Indian indirect taxation system. Although the transition process was a difficult one, GST provided the basis for a more interesting, efficient, and integrated taxation system. The full benefits of it will keep on coming out as the system is improved and matured.

GST was not a tax reform; it is a structural change that transformed the way business is conducted, governments raised revenue and consumers are charged tax. As the situation improves more and the policy remains stable, GST can play a huge role in boosting the economic structure in India.

Post Category

- RAS Salary

- Result

- RAS Admit Card

- RAS Job

- RAS Cutoff

- Preparation Tips

- RAS Answer Key

- RAS Exam Analysis

- RAS Syllabus

- RAS Previous Year Papers

- RPSC RAS Exam Pattern

- RAS Interview

- RAS Mains Exam Date

- RAS Vacancy

- RAS Test Series

- RAS Best Books

- RAS Preparation Resources

- RAS Coaching Centre

- History

- Polity

- Geography

- Economics

- Science

- Art and Culture

- RPSC RAS Application Form

- RPSC RAS Notification

RASonly Interview Guidance Program

Mr. Ashok Jain

Ex-Chief Secretary Govt of Rajasthan

- IAS officer of the 1981 batch, Rajasthan cadre.

- Passionate about mentoring the next generation of RAS officers with real-world insights.

- Got retired in Dec 2017 from the post of Chief Secretary of the state of Rajasthan.

Mr. Guru Charan Rai

Ex-ASP / SP in Jaisalmer

- Guru Charan Rai, IPS (Retd), retired as Inspector General of Police (Security), Rajasthan, Jaipur in 2017.

- Served as ASP and SP in Jaisalmer, Nagaur, Sri Ganganagar, Sawai Madhopur, Dausa, Sikar, and Karauli.

- He also held key positions as DIGP and IGP in the Law and Order division.

Mr. Rakesh Verma

Ex-IAS Officer, B.Tech, MBA, and M.A. (Economics)

- IAS officer of the 1981 batch and retired in Chief Secretary Rank.

- Civil servant of high repute and vast experience.

- Has been teaching UPSC CSE subjects for the last six years.

Related Post

Daily Current Affairs for RAS Exam Preparation 2026

First Maharudra Shaktipith to Be Established in Jaipur

January 27, 2026

Padma Awards 2026: List, Numbers and Rajasthan Winners

January 27, 2026

Vande Mataram 150 Second Phase Launched in Rajasthan

January 27, 2026

Rajasthan IT Games 2025-26 Launched in Jaipur

January 27, 2026👉🏻 Register Today to Join Classes! 👍🏻

- Team RASOnly -

🎯 Benefits of RASOnly Coaching:

- ✅ 1:1 Mentorship with RAS Officers

- ✅ Experienced and Expert Faculty

- ✅ Free Library Access

- ✅ Daily Minimum 4 Hours Must

- ✅ Comprehensive Study Material

- ✅ Regular Tests & Performance Analysis

- ✅ Personalized Guidance & Doubt Solving

- ✅ Online & Offline Class Options

- ✅ Affordable Fees with Quality Education

Key Highlights:

- 👉🏻 3-Day Refund Policy

- 👉🏻 New Batch Starting from 04 August

- 👉🏻 Registration Amount: Only ₹1000